This document represents the collective views of both the BAFT Supply Chain Finance Committee and the Global Supply Chain Finance Forum. This document is intended to provide our members a set of common market practices for Receivables Discounting. Members are encouraged to consult their own internal and external subject matter, legal, accounting and professional advisors to establish internal policies and procedures.

Enhancement of the standard definitions for Techniques of Supply Chain Finance

Enhancement of the standard definitions for Techniques of Supply Chain Finance

This document elaborates on an enhancement of the existing GSCFF Standard Definitions for Supply Chain Finance that have been released in 2016. Due to the global applicability of the SCF Definitions, it needs to be ensured that any changes to the existing SCF Definitions are carefully considered and aligned with all relevant stakeholders.

The update described in this document has been discussed and approved by the GSCFF Steering Board in October 2019.

This document describes the reasons, benefits and expected outcome of the proposed change and shall serve as a basis for actions that are required to accomplish the agreed change of the GSCFF Standard Definitions.

Foreword

This document elaborates on an enhancement of the existing GSCFF Standard Definitions for Supply Chain Finance that have been released in 2016. Due to the global applicability of the SCF Definitions, it needs to be ensured that any changes to the existing SCF Definitions are carefully considered and aligned with all relevant stakeholders.

The update described in this document has been discussed and approved by the GSCFF Steering Board in October 2019.

This document describes the reasons, benefits and expected outcome of the proposed change and shall serve as a basis for actions that are required to accomplish the agreed change of the GSCFF Standard Definitions.

History

The standard definitions for techniques of supply chain finance (in the further text referred to as ‘SCF Definitions’) were published in 2016, following a 2-year drafting period in which banks from all three regions participated. At the time of publication, the SCF Definitions were deemed to be complete and correct, as there was also a comprehensive consultation round with a larger circle of banks.

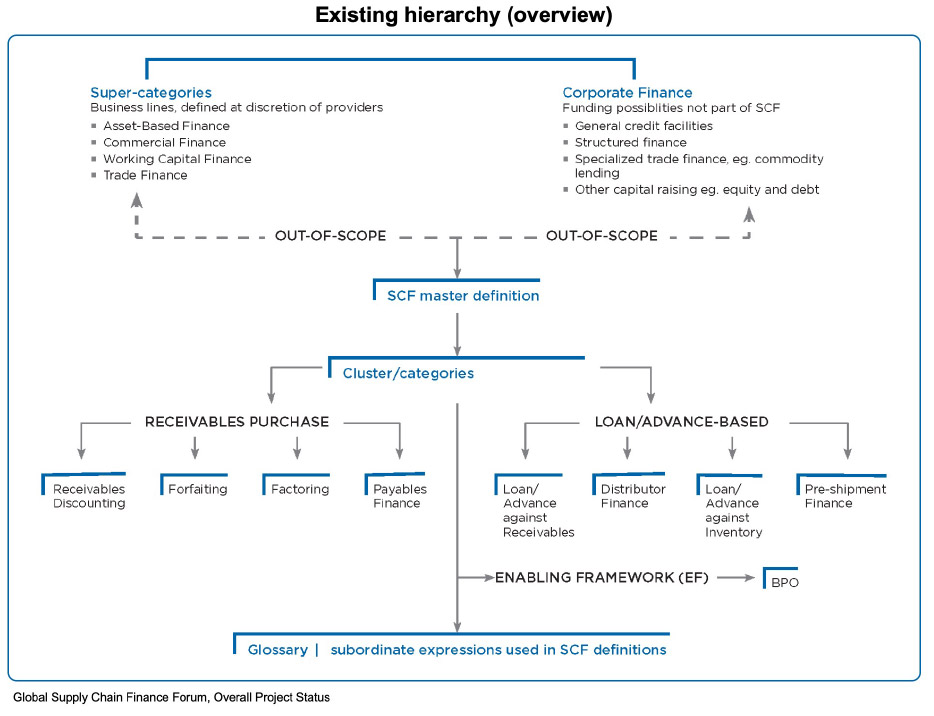

The SCF Definitions were highly welcome by the industry and since their publication, the terminology was largely adopted by banks. For recap purposes, the existing hierarchy is illustrated in below graphic:

Reasons / trigger for update

Still, 3 years after the publication, some banks stated that the SCF Definitions are not fully complete, as some techniques are not or insufficiently covered in the document. This is particularly the case for Payables Finance, which incorrectly serves as a common description for techniques that should in fact be distinguished from the Payables Finance technique as it is defined in today’s SCF Definitions.

Apart from Payables Finance, there are further techniques that can be taken up or differently reflected in the SCF Definitions document, i.e. Dynamic Discounting or the BPU (currently described as an enabling framework under the name of BPO).

Agreed update

The agreed enhancement of the SCF Definitions is an outcome from in-depth discussions with industry experts over the past months and seeks to provide more clarity on the distinctions between the individual techniques.

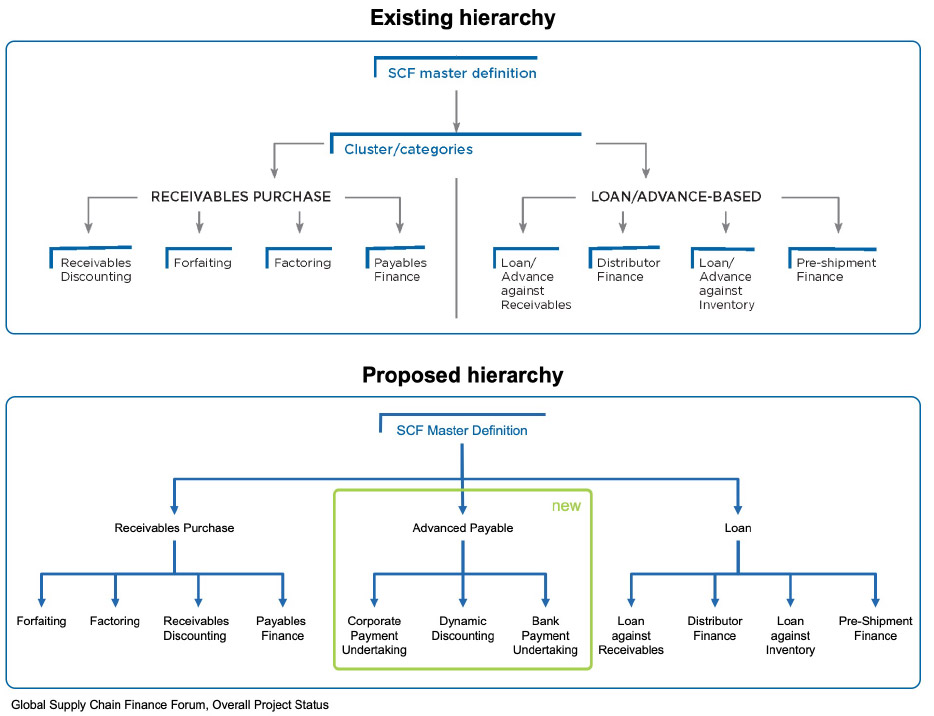

The most substantial change is that a third sub-category will be introduced, called ‘Advanced Payable’ (alternatively: ‘Early Payment’ or a similarly appropriate expression), comprising three techniques: Corporate Payment Undertaking, Dynamic Discounting and Bank Payment Undertaking. Subsequently, the third category (currently named ‘Loan-/Advance-based’) would be re-named into ‘Loans’. Apart from that, the existing categories will not change in content. A comparison of the existing hierarchy and the proposed hierarchy is illustrated below:

The three new techniques in short:

Corporate Payment Undertaking: A deviating understanding of Payables Finance where the buyer sends a payment instruction to the Finance Provider and the seller will receive an advanced (or early) payment. The deviation results from the fact that unlike in a Payables Finance scenario, the Finance Provider will not purchase the underlying receivable from the seller, but fully rely on an irrevocable payment undertaking from the buyer.

Dynamic Discounting: An advance payment that is directly paid by the buyer to its seller. Unlike in other SCF techniques, there is no financing from the Finance Provider but rather a service to the buyer / seller in calculating (and optionally processing) the discount amount the buyer needs to pay. The buyer will pay the original invoice amount at a discount out of its own cash.

Bank Payment Undertaking: A technique that leverages a B2B network (that can be DLT-based). Following a ‘matched transaction’ in that network, a bank may issue a payment undertaking at the benefit of a corporate beneficiary or another bank. Such Bank Payment Undertaking may be the basis for a financing.

Why now?

One may ask why this logic was not published with the initial release of the SCF Definitions. Reasons are:

At the time of drafting the SCF Definitions, there was unanimous agreement to focus on ‘one’ real type of Payables Finance, which is described in the current version of the document. A reason for not factoring in the ‘CPU-variation’ also was that at that time it was important to establish a structure, which was done by creating categories. The categories that were chosen were ‘Receivables Purchase’ and ‘Advance-/Loan-based’, and the ‘CPU-variation’ did not fit into any of these categories. Moreover, the Receivables Purchase variation was deemed as the more prominent one if compared with each other. In the existing ‘Variations’ sub-section of the Payables Finance section there is indeed mentioning of ‘Confirming’, which is a binding commitment of the buyer, and ‘Dynamic Discounting’. Both variations would fall into the ‘Advanced Payable’ section in the new hierarchy, as they do not represent the purchase of a receivable.

There was also an understanding that the SCF Definitions should focus on techniques where banks render a financing service to a client. For Dynamic Discounting, this is not the case, and this technique was deemed as a service that is rather offered by non-banks than banks.

With time moving on, banks and non-banks are cooperating much closer, and there are different flavors of engagement models between these parties with Dynamic Discounting service being offered by a non-bank, white-labelled by a bank, or even originated by a bank-owned software. From a corporate seller perspective, a Dynamic Discounting transaction still is a discounted payment, so it seems appropriate to consider Dynamic Discounting as part of the ‘SCF family’.

The BPO at the time of drafting the SCF Definitions was a relatively new instrument that was somehow seen as relevant for SCF, however, after long debates, did not make it into any category, but was taken up as an enabling framework for a subsequent financing to a corporate—leaving open the question into which category such financing would fall. The BPO is also a very specific and defined instrument that even has an own set of rules (URBPO).

The BPU as it is intended to be described in the new version of the SCF Definitions is a more generic payment undertaking, resulting from prior matching service in a network. Such BPU could come in the form of a BPO, but it would not be limited to a BPO. The intention of describing the BPU in a more generic manner is to open up the SCF Definitions to the recent and oncoming developments with regards to marketplaces and networks where banks, non-banks and corporates exchange trade-related data. The technique shall be technology-agnostic and open for any form of trusted network that already exists or will be there in the future.

Expected benefits

Since its release in 2016, the SCF Definitions have been criticized by some market participants for not being complete. The proposal to extend the SCF Definitions takes this criticism into account and will reflect a more complete view of the actual business that is currently being practiced in the market.

The benefits of this change are manifold:

- More clarity on Payables Finance vs. the Corporate Payment Undertaking

- More complete reflection of existing market practices

- Higher agility from inclusion of ‘network’ approach

- Higher acceptance of the SCF Definitions by market participants

In summary, the proposed extension is expected to bring substantial benefit to the SCF Definitions from a content perspective and will make it easier for market participants to adopt the definitions for their own business. The fact that the Definitions are updated 4 years after its initial release also demonstrates a level of agility that seems appropriate in the dynamic field of Supply Chain Finance.

Expected ramifications

GSCFF / ICC documents

The extension of the SCF Definitions will create some repercussions on the document itself as well as on other publications.

| SCF Definitions |

|

| Guidance Papers for other SCF techniques |

|

| ICC Trade Survey + ICC Trade Register | Decision on the scope of techniques to be reported in the ICC Trade Survey and the ICC Trade Register. Particularly for the ICC Trade Register, the understanding of Payables Finance vs. Corporate Purchase Undertaking needs to be clarified, as there is currently no distinction between the two techniques. This will require some debate, but will ultimately also be beneficial to the purpose of the Trade Register, as the risk profile between the two techniques is potentially different. |

Finance providers

No impact on existing processes or legal documentation is expected from the proposed change. As with the initial publication, a finance provider may take a deliberate decision to offer any product at its own discretion and make a reference to the SCF Definitions. The new structure will offer a wider array of techniques and hence enable a finance provider to make a more precise reference of its own product offering to the SCF Definitions

Corporates

Similarly, corporates (buyers / sellers) will be free to choose any finance provider and service they deem as beneficial for their individual financial needs. The SCF Definitions in their updated form will provide more clarity and enable corporates to make a more qualified decision on the particular service they require.

Auditors, Rating Agencies, Investors, Regulators

From an external perspective, the distinction between Receivables Purchase and Advance Payable techniques may be pivotal when it comes to opining on e.g. corporate accounting, the assessment of credit risk or usage of bank capital. The SCF Definitions in their updated form will provide more clarity to external parties and also allow to avoid uncertainty in the assessment of the individual techniques, as they are described in a more detailed manner.

How to

The GSCFF is calling for candidates who contribute to the three new techniques. To ensure consistency and comparability with the remaining document, all techniques should be described in a similar structure as the existing techniques.

In order to ensure consistency across the main document, the GSCFF is also looking for a final editor, preferably a native English speaker.

Time Frame

It seems appropriate to finalize the currently ongoing initiatives on creating an industry guidance on Payables Finance. The work on the main document should be initiated by 2019/2020, leaping into 2021, so that a finalized new version would be available in the course of 2021, or – depending on the complexity of the drafting process – by 2022 latest.