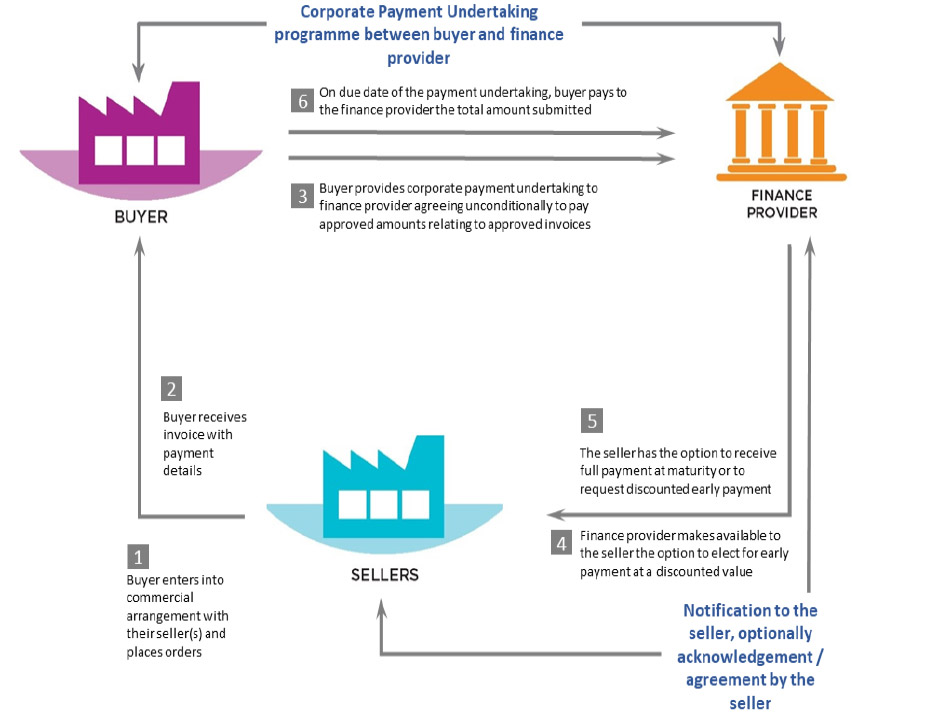

Corporate Payment Undertaking is provided as a buyer-led programme within which sellers in the buyer’s supply chain can, at their option, access liquidity by means of receiving discounted early payment. Such payment to a seller covers seller’s invoices (or buyer approved amounts relating to such invoices). The technique provides a seller of goods or services (seller) with the option of receiving the discounted value as early payment of outstanding invoices (that have an unconditional approval by the buyer to pay on the due date) prior to their actual due date and typically at a discount with cost of early payment more aligned to the credit risk of the buyer.

Whereas in Payables Finance the finance provider enters into receivables purchase arrangements with a seller, under a Corporate Payment Undertaking programme the early payment does not require receivables purchase but may require the seller to confirm the finance provider’s right to receive buyer payment and/or pass-through arrangements and/or acceptance as full payment of the approved invoice amount.

This SCF technique is subject to several naming conventions (consistency should be encouraged), which can overlap with Payables Finance. The Forum decided that the term Corporate Payment Undertaking is an appropriate name that captures the essence of the technique.