Forfaiting is a form of Receivables Purchase, consisting of the without recourse purchase of future payment obligations represented by financial instruments or payment obligations (normally in negotiable or transferable form), at a discount or at face value in return for a financing charge.

Definition

FORFAITING

Synonyms

- Without recourse financing

- Discounting of promissory notes

- Discounting of bills of exchange

Distinctive features

Forfaiting requires the existence of an underlying payment obligation usually embodied in some form of legal instrument distinct from the commercial transaction that gave rise to it. Such commercial transactions could be exports, imports or domestic trade. Typical payment instruments include negotiable instruments such as bills of exchange and promissory notes but obligations arising from letters of credit are also widely forfaited. All of these are ideal for forfaiting because they are, by law or agreement, independent from the underlying trade, benefit from a robust legal regime, and are easily transmissible to third parties through endorsement or assignment. This legal autonomy, founded on well-established law and precedent, giving rise to receivables which may be easily sold is a hallmark of forfaiting.

Such obligations may or may not be guaranteed by third parties such as banks, for example, by adding an aval or guarantee to a negotiable instrument. The range of payment obligations capable of being forfaited is not, however limited to these instruments but is very wide. Suitably worded and assignable contractual undertakings e.g. open account receivables can also be forfaited, but will normally need to include an unconditional obligation to pay.

There is a primary and secondary forfaiting market.

In the primary market, transactions are originated and obligations can be purchased from sellers of goods and services or their buyers, often in the latter case involving a bank in the buyer’s country. Pure working capital can also be raised through forfaiting by purchasing a promissory note or an unconditional payment undertaking from the finance provider.

The secondary market is conducted between finance providers such as banks, forfaiting houses or other investors.

Tenors can vary from one month to several years. Transaction sizes are generally at the higher end of the supply chain spectrum and large volumes of low value instruments are more commonly confined to domestic forfaiting. The advance ratio is normally 100% of the face value of the payment obligation less finance charges. There may be one or more such instruments in any given transaction although the number is usually small.

Forfaiting is undertaken without recourse to the seller of goods and services or, in the secondary market, the seller of the forfaited asset (see below in ‘Risks and risk mitigation’).

Parties

In the primary market there is normally a seller of goods and services (e.g. exporter) or buyer (e.g. importer) as seller of the instrument or payment obligation to the initial finance provider (commonly known as the primary forfaiter). In the secondary market, there will be sellers and buyers (forfaiting), usually composed of finance providers and investors.

Contractual relationships and documentation

In the primary market there will be either a master agreement with a confirmation for each individual transaction or a one-off agreement limited to a single transaction.

In the secondary market, a sale is legally concluded either by telephone and then confirmed in writing or there is a written confirmation only following earlier non-binding discussions.

The payment instrument containing the obligor’s undertaking to pay will be obtained either directly from the obligor or through transfer of such instrument.

In a forfaiting transaction the documentation relating to the underlying commercial documentation will be examined by each purchaser of the forfaited asset to the extent required by its policies and legal obligations.

The extent to which the documentation is examined will vary according to which market is involved (there being generally less documentation produced in the secondary market), the risk appetite of the parties and the nature of the transaction. There is likely to be less documentation in the case of a ‘buyer credit’ than in the case of a ‘supplier credit’.

Forfaiting transactions can be documented using the Uniform Rules for Forfaiting ICC Publication no. 800 (URF) which is a joint publication of the International Chamber of Commerce and the International Trade and Forfaiting Association. The URF took effect on 1st January 2013 and contains a set of rules for the conduct of the primary and secondary markets including provisions covering the examination of documents and the liability of parties. A set of model agreements for both markets is included.

Security

Generally, Forfaiting results in a “true sale” whereby the buyer owns all the rights in the forfaited payment obligation. Security in respect of the forfaited asset can be given in the form of an aval or guarantee from a third party.

Risks and risk mitigation

- Default by, or insolvency of the Buyer, mitigated by security, credit insurance and due diligence

- Country or political risk, mitigated by due diligence and political risk insurance. Special circumstances relating to sovereign risk may apply to receivables due from governments or government agencies

- Dilutions and disputes arising out of the underlying commercial transaction, mitigated by use of unconditional payment instruments and limited recourse to the seller

- The risk arising from removing recourse to the seller of goods and services or, in the secondary market, a seller of the forfaited asset, mitigated by the credit rating of the buyer and limited recourse in certain circumstances (see Article 13 URF)

- KYC/AML handled during the on-boarding procedures and subsequently in periodic reviews

- Risks arising in the event of insolvency of the seller of goods and services, such as ‘claw-back’, especially where a finance provider is aware of distress at the time of financing mitigated by due diligence

- Fraud by the seller, for example by inflating the value of payment instruments or offering payment instruments without an underlying commercial transaction, mitigated by verification of the transaction and deploying adequate credit controls

- Double financing, mitigated by obtaining ownership of the forfaited receivable, applying appropriate KYC procedures and perfecting the assignment of rights to the forfaited receivable

- Fraud by collusion between the seller and one or more of its buyers leading to diversion of funds from meeting maturing obligations, mitigated by monitoring the financial health and management integrity of the seller through maintaining contact and receiving regular management information to look for signs of a deterioration of the business and suspicious circumstances, and also mitigated where necessary, by direct collections on the part of the finance provider

- Fraud by collusion between the seller of goods and services and an employee of the finance provider, mitigated by internal controls and segregation of duties

- General operational risks resulting from multiple operational requirements to perfect ownership of receivables and undertake ongoing administration, mitigated by sound procedures, appropriate levels of automation and process controls

- Legal risks such as lack of authority to sign documentation, payment instruments being in unenforceable form, and failure to perfect an assignment of rights, mitigated by legal due diligence

- In general, the finance provider will exclude prohibited and restrictive categories of goods

- Currency and interest rate risks, mitigated by hedging

All the above risks are also mitigated by a robust monitoring, reporting and audit process regarding transactions, systems, and controls.

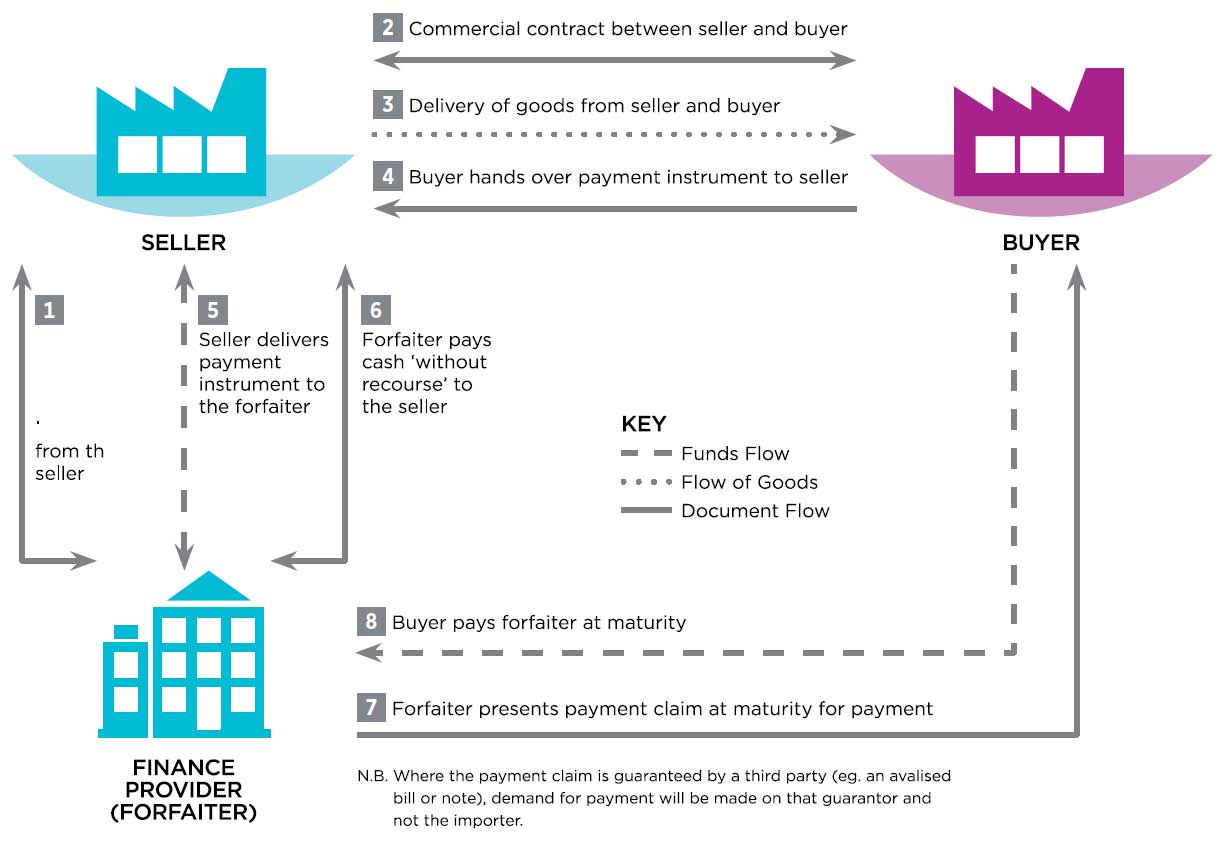

Transaction flow: illustrative only

Source: Global SCF Forum

Transaction illustration

Generally, forfaiting is a manual or semi-manual process. Sale and purchase documentation is negotiated and signed between parties in both primary and secondary markets in hard copy. Individual transaction confirmations can be sent by email or SWIFT.

Due diligence and credit analysis will need to be carried out on the obligors and on the legal nature of the instruments being used with a view to ensuring that, so far as possible, these are valid and enforceable even where problems may arise in the related sale of goods. The need for any local registrations and permissions will also be investigated.

Ownership to the payment instrument being used must pass to the purchaser and the appropriate legal method of doing this must therefore be ascertained. These can include assignment, novation or endorsement. There may be a need to hold and/or present originals of the payment instruments for payment to the obligor. The precise situation will depend on the nature of the instrument.

Confirmations from obligors to pay the new holder of the payment instrument are often sought especially in relation to letters of credit where the forfaiter is not a nominated bank under the letter of credit and is thus not a party to that transaction.

KYC/AML must be carried out on all relevant parties including the seller and the obligors in accordance with applicable local requirements.

Documentation relating to the export or import of goods must be examined manually with a view to satisfying not only KYC/AML requirements but ensuring the transaction is capable of being financed and that all documentation is authentic and legally valid and enforceable. URF 800 sets out rules for examination of such documents.

Benefits

- Working capital optimisation for buyer and seller

- Potential finance raised against a strong credit rating (either of buyer or financial institution providing security for the payment obligation) with lower implied cost of funding for the seller

- Assists sellers in selling to buyers or countries where they have little local knowledge and open-account sales would not otherwise be possible

- Potentially improved payment and commercial terms for the seller and buyer

- Finance and liquidity availability for sellers with limited credit availability from traditional banking sources

- Supply chain stability

- Relieves sellers of goods and services of administration and collection costs

Asset distribution

By outright or “true” sale and through funded or unfunded (risk) participation agreements.

Variations

See “Distinctive Features” above.