Distributor Finance is the provision of financing for a distributor of a large manufacturer to cover the holding of goods for re-sale and to bridge the liquidity gap until the receipt of funds from receivables following the sale of goods to a retailer or end-customer.

Definition

Distributor Finance

Synonyms

- Buyer Finance

- Dealer Finance

- Channel Finance

- Floor Plan Finance (latter not always stricly comparable)

Distinctive features

The funding facility is typically offered to the distributor (or buyer) of a large manufacturer/ exporter in the form of direct financing by means of loans or advances, subject to annual review. These facilities are, typically, used for funding inventory and receivables on a short term basis The underlying need that is being fulfilled, is to permit smaller/local distributors to obtain financing, especially if they have limited access to other sources of funding, and where there is a material timing gap between the credit terms of the large manufacturer selling to them, and the date by which the goods can be sold and receivables converted to cash. Typically, the distributor is a third-party owned company, but it could be owned or part-owned by the large manufacturer.

The risk is mitigated by ensuring that the large manufacturer, often called the ‘anchor party’, is closely engaged and has a certain degree of exposure to motivate successful conduct of the distributor’s contractual arrangements. There may be a specific agreement between the anchor party and the finance provider. Additional engagement by the anchor party could take the form of various types of risk-sharing arrangements. The distributor could benefit from better loan pricing than would have been the case had the distributor sourced financing solely on the strength of its own balance sheet. The distributor is usually expected to meet the characteristics of being a well-established business with stability and a record of success in acting as a distributor.

Parties

The parties to distributor finance are large manufacturers acting as sellers (often called ‘anchor parties’) their distributors acting as buyers, and finance providers.

Contractual relationships and documentation

A financing agreement or facility letter is typically established directly between the distributor and the finance provider. In addition, there is often a master Distributor Finance agreement between the anchor party and the finance provider that would contain the terms of engagement for the finance provider to provide facilities for multiple distributors in a number of global territories, any agreed risk-sharing arrangements, and the operating model applying to the three parties – i.e., the anchor party, the distributor, and the finance provider.

Security

Since this is a direct financing in favour of the distributor, the security is usually an assignment of rights over inventory and receivables and/or other forms of security, as agreed between the distributor and finance provider. Given that the borrower is likely to be an SME, considerations of risk in relation to the adequacy of security will be required in the usual way. Additional risk mitigation is provided by the engagement of the large manufacturer. This could take the form of a master Distributor Finance agreement, a stop-supply letter, a buy-back guarantee, a comfort letter, or a risk sharing arrangement. Care is required in assessing the value of the latter undertakings, as practitioners vary in the evaluation of their value and the feasibility of obtaining them.

Risks and risk mitigation

In addition to generic financing-related risks, there are a series of risks specific to Distributor Finance. They are:

- Default by the distributor, including credit and political risk, mitigated by careful credit risk assessment and continuous monitoring. The importance of the particular distribution contract to the borrower’s business survival is an important factor to be evaluated

- Diversion of funds, such as a situation, where the distributor uses borrowed funds for other reasons (such as financing the growth of the business in other directions) rather than repaying the financing mitigated by the large manufacturer supporting the distributor finance programme by providing information about the performance of the distributor, and/or any agreement for risk sharing

- Operational risks especially the requirement to coordinate many commercial and financial components, mitigated by automation, management quality and business controls

- Pre-existing security arrangements, mitigated by waivers or their removal, or by taking additional security

- Fraud by the distributor or by collusion, mitigated by monitoring and verification

- Lack of authority, mitigated by legal due diligence

All of the above risk mitigation would be augmented by a robust audit process (or field-surveys and visits to the distributor’s business).

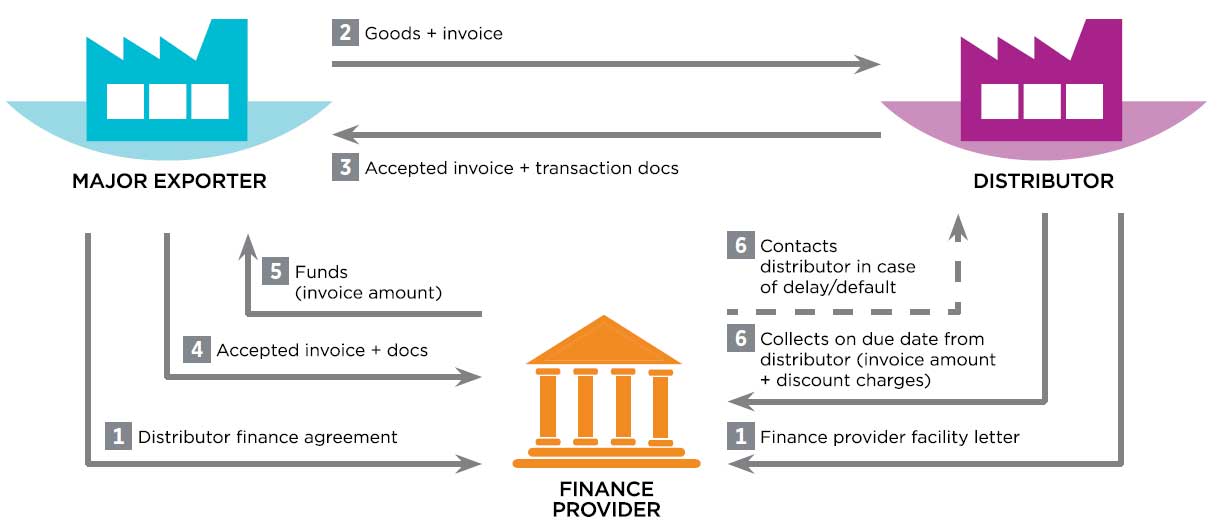

Transaction flow: illustrative only

Source: Global SCF Forum

Transaction illustration

The operational process model may be manual, semi-manual or automated by a technology platform provided by the finance provider. Global finance providers often offer Distributor Finance programmes via web-based platform solutions tailored for their multinational clients. These platforms are accessed by the seller and distributors for purchase order approvals, invoice confirmations, and the handling and tracking of payments and drawdowns.

Benefits

For the distributor (or buyers) of a large exporter/manufacturer it provides:

- Working capital optimisation permitting the distributor to bridge the liquidity gap between the purchase of inventory and payments received from its customers

- Increased credit for distributors (esp., distributors with limited credit availability from the traditional banking sources) based on the existence of actual financial or commercial support from the large manufacturer

- Credit for distributors at a lower cost than what would be available from traditional banking sources.

For the large manufacturer, potentially allows for generating sales growth (by providing additional finance to increase product availability through distributors, the finance of inventory and support for the prompt delivery of products, especially in emerging and frontier markets). Potentially allows the large manufacturer to provide extended credit terms to the distributor or to ensure that additional funding can be raised with its support.

Variations

A variation of Distributor Finance arises where a large manufacturer acting as seller provides extended or longer than usual credit terms to the distributor, and a finance provider agrees to enter into a Receivables Purchase facility with the large manufacturer. The distributor is thereby provided with liquidity to finance its order to cash cycle as a result of the extension of credit. In turn the finance provider is able to provide the large manufacturer with the means of financing the longer credit terms on a basis agreed between them.

There are a variety of other financing arrangements, which could be offered to a distributor, such as factoring, leasing, invoice discounting and regular working capital finance not covered herein.

Asset distribution

Not usually applicable but for larger facilities, syndication may be utilised.